EVNFinance's audited pre-tax profit increased by 72%

Thursday, March 6,2025

AsemconnectVietnam - Electricity Finance Joint Stock Company (EVNFinance - stock code: EVF) has just announced its audited financial report for 2024.

EVNFinance is among the few listed credit institutions that announced the earliest audited financial report on the stock market.

On February 28, 2025, EVNFinance announced its 2024 financial report audited by A&C Auditing and Consulting Co., Ltd., Hanoi Branch. Accordingly, EVNFinance's pre-tax profit in 2024 increased by nearly 72% compared to pre-tax profit in 2023 and there was no difference compared to the previously announced self-reported figures.

Net interest income in 2024 reached VND1,444 billion, double that of net interest in 2023. Interest expense and similar expenses in 2024 decreased by VND452 billion compared to interest expense in 2023, equivalent to a decrease of 13.7%. The ratio of interest expense to interest income at 31/12/2024 was 66.2%, while this ratio at 31/12/2023 was 82.2%, showing that EVNFinance's business efficiency and cost management have improved very well. Foreign exchange trading activities have improved in quality, although the loss in 2024 was VND43 billion, it has decreased compared to the loss in 2023 of VND86.5 billion. According to the Balance Sheet, EVNFinance's total assets increased by 21% from VND49,221 billion at December 31, 2023 to VND59,598 billion at December 31, 2024. Charter capital also increased from VND7,042 billion at the end of 2023 to VND7,605 billion in 2024, as a result of EVNFinance paying dividends in shares at a rate of 8% to existing shareholders. In 2024, EVNFinance proactively built a safe and sustainable capital structure with the proportion of capital mobilization from market 1 and valuable papers accounting for nearly 60% of total mobilized capital. EVNFinance's mobilized capital has grown in all mobilization channels, in which customer deposits at 31/12/2024 increased impressively by 240%, more than 3 times higher than at 31/12/2023.

Regarding lending activities, the total outstanding customer loans at 31/12/2024 reached VND46,802 billion, in which EVNFinance's loan quality continued to be well maintained and ensured the bad debt ratio continued to be below 1%.

In addition, according to the financial statement, EVNFinance's lending activities in 2024 will be diversified in industries and economic types, in which lending to businesses operating in the construction and real estate sectors has decreased from 24% in 2023 to 19% in 2024. At the same time, EVNFinance also increased lending to businesses operating in the trade and service sectors to rotate short-term capital faster, with commercial lending accounting for nearly 26% in 2024.

According to EVNFinance, in the last 6 months of 2024, EVNFinance will also focus on lending to businesses in the green and smart mobility sector, increasing the loan balance for renewable energy and solar energy.

Also according to the financial statement notes, the lending ratio for each customer, each customer and related person of EVNFinance complies with the Law on Credit Institutions 2024 and related legal documents. Regarding long-term investment capital, according to the report notes, the ratio of capital contribution to companies in the process of investing and implementing projects on the total value of capital contributions as of December 31, 2024 has decreased by 36.9% compared to December 31, 2023.

The fact that the figures in the audited financial statements remain unchanged compared to EVNFinance's self-prepared Q4 2024 report shows that EVNFinance has accounted and prepared reports according to accounting standards and fully complied with legal regulations. In recent years, EVNFinance has always been one of the few listed credit institutions to issue audited financial statements earliest in the market.

N.Nga

Source: VITIC/Tinnhanhchungkhoan

Thanh Cong Textile Garment (TCM) targets 2025 profit to increase slightly to VND278.7 billion

VIB plans to pay a maximum dividend of 7% in cash, increasing charter capital to over VND34,040 billion

Sao Ta (FMC): Revenue increased by 85% in February

PV GAS signs 25-year LNG supply contract for Nhon Trach 3 and 4 Power Plants

BaF Vietnam Agriculture (BAF) invests VND760 billion to establish 3 subsidiaries in Tay Ninh

Hoa Sen (HSG) proposes 2 business scenarios for 2025, plans to buy back 50-100 million treasury shares

Phu My (DPM) and Hanwa sign cooperation agreement to supply 20,000 tons of urea to the Japanese market

Dong Nai Water Supply Joint Stock Company (DNW) expected profit to decrease by 22% in 2025

Dong Nai Port (PDN) pays 20% dividend for the first time in 2024

Phuc Hung Holdings (PHC) will hold the 2025 General Meeting of Shareholders at the end of April 2025

Aviation Insurance (VNI) reaches VND2,895 billion in revenue in 2024

Hoa An (DHA) targets 11% profit growth in 2025

FPT Retail (FRT) plans to generate VND48,100 billion in revenue in 2025

Hoa Sen (HSG) subsidiary approved to invest in expanding steel factory with capacity of 350,000 tons

Plan of Hai Duong province for a period of 2021 - 2030, ...

Organize space reasonably and harmoniously, focusing on connecting Hai Duong in common development space, actively contributing to the ...Plan of Hau Giang province in a period of 2021 - 2030, ...

Sustainable forestry development program in a period of ...

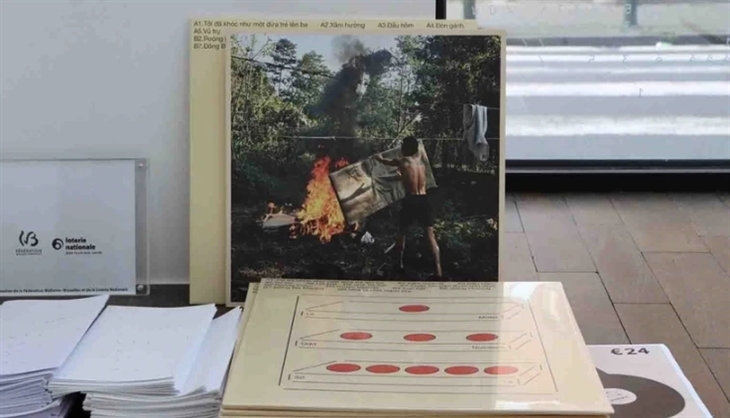

From Hanoi to Brussels – a cross-cultural musical journey

“Odd Numbers” is not only a musical project but also a meaningful cultural journey. The project demonstrates the intersection between two ...Talented youngsters to enjoy int'l football ...

Tien Linh, Thuy Trang win Vietnam Golden Ball 2024

HCM City’s ao dai festival to feature mass folk dance with ...