Seafood exports to the EU increased by 9.6% in August 2024

Thursday, October 24,2024

AsemconnectVietnam - According to statistics from the General Department of Vietnam Customs, Vietnam's seafood export turnover to the EU in August 2024 reached 101.2 million USD, up 1.8% compared to July 2024 and up 9.6% compared to August 2023

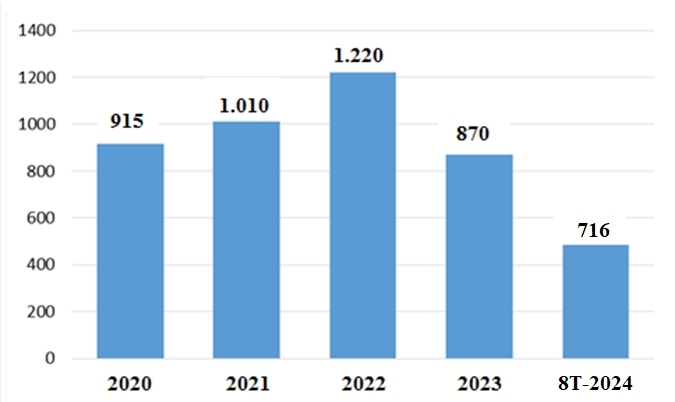

In the first 8 months of 2024, Vietnam's seafood export turnover to the EU reached 716.08 million USD, up 12.3% over the same period in 2023. Thus, Vietnam's seafood export turnover to the EU accounts for 11.3% of the total seafood export turnover.

Typhoon No. 3 recently hit and caused significant damage to northern provinces, particularly coastal areas such as Quang Ninh, Hai Phong, Thanh Hoa, and Nam Dinh. The storm severely impacted seafood supply, with major losses reported from aquaculture farms. In response, Vietnamese enterprises are proactively balancing raw material supplies and financial resources to maintain traditional customers and ensure supply readiness. They are also adjusting export market structures and product portfolios while increasing the import of raw materials for export production and outsourcing. These efforts aim to leverage processing capacity, boost export turnover, and maintain stable employment for workers. Vietnam’s seafood exports have accelerated in the second half of 2024, peaking in the third quarter.

Vietnam's Seafood Exports to the EU in the First eight months of 2024

Unit: Million USD

Source: Calculated from Vietnam Customs data

Structure of EU Member Markets by Export Turnover from Vietnam

The Netherlands remains Vietnam’s largest seafood importer, with exports reaching USD21.5 million in August 2024, a 23.1% increase compared to July 2024. In the first eight months of the year, exports to the Netherlands amounted to USD136.1 million, an increase of 12.2% over the same period in 2023, accounting for 19% of Vietnam’s total seafood exports to the EU market.

Germany ranks second, with exports valued at USD20.9 million in August 2024, up 35.9% compared to July 2024. For the first eight months, seafood exports to Germany totaled USD130.6 million, a 7.1% increase from the same period in 2023, representing 18.2% of Vietnam’s total seafood exports to the EU.

Belgium ranks third, with exports reaching USD14.7 million in August 2024, a growth of 8.06% compared to July 2024. Over the first eight months, exports to Belgium totaled USD94.3 million, an increase of 16.5% compared to the same period in 2023, accounting for 13.1% of Vietnam’s total seafood exports to the EU.

Next is Italy, with exports valued at USD7.4 million in August 2024, a decrease of 27.2% from July 2024. For the first eight months, seafood exports to Italy reached USD66.8 million, up 15.6% from the same period in 2023, making up 9.3% of total seafood exports to the EU.

Spain ranks fifth, with exports amounting to USD6.9 million in August 2024, down 13.8% from July 2024. Cumulatively, exports to Spain totaled USD49.01 million in the first eight months, increasing by 21.01% compared to the same period in 2023, representing 6.8% of Vietnam's total seafood exports to the EU.

Notably, beyond the top three export markets, several others saw high export growth during the first eight months of 2024. Exports to Ireland grew by 53.07%, Slovenia by 36.2%, Lithuania by 30.4%, and Denmark by 23.8%. Exports to Bulgaria experienced particularly strong growth, surging 149.2% compared to the same period in 2023.

Vietnam's Seafood Export Markets to the EU in the First Eight Months of 2024

(According to data released by the General Department of Vietnam Customs on September 10, 2024)

Unit: USD

|

Market

|

August of 2024

|

First eight months of 2024

|

||||

|

Value (USD)

|

Month-on-month (%)

|

Year- on- year

(%) |

Value (USD)

|

Year- on- year (%)

|

Market Share (%)

|

|

|

Total Export Turnover

|

101.240.440

|

1,8

|

9,6

|

716.081.085

|

12,3

|

100

|

|

Netherlands

|

21.502.636

|

23,17

|

36,83

|

136.177.060

|

12,25

|

19,02

|

|

Germany

|

20.947.195

|

35,95

|

10,11

|

130.676.029

|

7,14

|

18,25

|

|

Belgium

|

14.775.983

|

8,06

|

30,67

|

94.397.580

|

16,55

|

13,18

|

|

Italy

|

7.414.633

|

-27,28

|

-37,4

|

66.816.666

|

15,6

|

9,33

|

|

Spain

|

6.963.597

|

-13,82

|

20,6

|

49.019.507

|

21,01

|

6,85

|

|

Pháp

|

4.940.312

|

-6,44

|

-9,31

|

35.028.622

|

-18,36

|

4,89

|

|

Denmark

|

3.927.104

|

2,41

|

13,4

|

34.654.339

|

23,82

|

4,84

|

|

Ba Lan

|

3.700.463

|

-9,5

|

-5,21

|

28.514.008

|

-1,84

|

3,98

|

|

Lithuania

|

4.712.712

|

5,55

|

26,71

|

28.483.966

|

30,48

|

3,98

|

|

Egypt

|

5.570.013

|

4,3

|

14,9

|

26.973.743

|

6,3

|

3,77

|

|

Rumania

|

3.221.343

|

-19,49

|

97,98

|

22.114.288

|

32,84

|

3,09

|

|

Portugal

|

4.665.148

|

77,9

|

58,52

|

21.899.534

|

-2,88

|

3,06

|

|

Sweden

|

1.389.010

|

-29,96

|

-21,72

|

15.161.731

|

17,7

|

2,12

|

|

Ireland

|

1.093.313

|

3,52

|

-14,7

|

5.545.617

|

53,07

|

0,77

|

|

Greece

|

88.366

|

-78,65

|

-84,86

|

5.402.091

|

-2,86

|

0,75

|

|

Cyprus

|

120.941

|

-36,56

|

-35,48

|

4.370.250

|

9,13

|

0,61

|

|

Bulgaria

|

246.433

|

-65,02

|

-7,2

|

3.548.917

|

149,2

|

0,50

|

|

Slovenia

|

348.920

|

7,7

|

-14,2

|

3.009.726

|

36,2

|

0,42

|

|

Finland

|

348.050

|

891,3

|

-69,1

|

2.549.316

|

-71,6

|

0,36

|

|

Hungary

|

92.718

|

-42,9

|

-82,07

|

2.395.526

|

41,3

|

0,33

|

|

Latvia

|

267.887

|

48,2

|

37,7

|

2.480.068

|

0,70

|

0,35

|

|

Czech Republic

|

201.812

|

284,9

|

-17,24

|

1.602.821

|

-14,91

|

0,22

|

|

Croatia

|

213.515

|

106,1

|

-31,6

|

317.109

|

-88,3

|

0,04

|

|

Malta

|

58.348

|

22,1

|

-44,2

|

567.829

|

-33,4

|

0,08

|

Source: Calculated from Vietnam Customs data

Some markets experienced a decline in export turnover in the first eight months of 2024 compared to the same period last year: Exports to France decreased by 18.3%; exports to Finland dropped by 71.6%; exports to Poland fell by 1.8%; exports to Portugal declined by 2.8%; and smaller markets such as the Czech Republic, Croatia, and Malta saw decreases of 14.9%, 88.3%, and 33.4%, respectively.

The pressure of competition regarding export prices and supply, along with challenges in domestic processing production such as rising input costs and raw material shortages, will continue to impact Vietnam's seafood exports in the coming months of 2024. However, Vietnam has gained significant experience in exporting seafood to demanding markets like the EU and maintaining and improving food safety standards will be crucial for ensuring the sustainable development of the industry. Additionally, the strong growth of Vietnam's seafood exports can be attributed to the diversification of products and export markets. Seafood enterprises have continually improved technology, enhanced product quality, and met international standards. Furthermore, government support policies also play an important role in promoting seafood exports.

Vietnam is currently the world's largest producer and exporter of pangasius, accounting for 52% of the total production and 90% of global pangasius trade. In terms of shrimp exports, Vietnam ranks second in the world, comprising 13-14% of the total value of global shrimp exports. Processed shrimp has become a significant advantage for Vietnam, consistently ranking among the top four shrimp suppliers globally, alongside Ecuador, India, and Indonesia.

Out of approximately USD5.5 billion in processed shrimp imported by countries worldwide, Vietnam alone accounted for USD1.5 billion. This figure is the highest among major exporting countries such as Ecuador and India. This also indicates that Vietnam's shrimp processing capacity meets the demands of certain markets, even in the coming years. However, from an industry-wide perspective, Vietnam's shrimp exports still rely heavily on the frozen shrimp segment, which contributed 62% of the total turnover last year, while value-added shrimp accounted for 38%.

However, a limitation of Vietnam's frozen shrimp exports is that production costs are too high. One of the major issues facing the shrimp industry in Vietnam, particularly in the Mekong Delta, is the high cost of raw shrimp production due to a low success rate of about 40%.

In the first eight months of 2024, seafood exports to the EU have shown positive recovery signals. According to market trends, from the beginning of the fourth quarter onward, importers will increase their purchases to prepare supplies for the year-end holidays. It is forecasted that Vietnam's seafood exports will continue to see more favorable growth in the remaining months of 2024.

The EU will focus on inspecting Vietnam's residue control system for exported seafood products to ensure food safety for European consumers and to assess whether Vietnam can maintain and improve necessary standards.

The two main export items of Vietnam's seafood industry are shrimp and pangasius. Despite some growth, export companies are facing numerous difficulties and must seek new directions. The shrimp industry is confronted with two major issues: low export prices due to competition with shrimp from Ecuador and India, and complex disease outbreaks in farmed shrimp that have not yet been resolved, which could lead to a shortage of shrimp supplies in the latter months of 2024. Shrimp prices from the fourth quarter of 2024 onward are likely to improve compared to the present, but a significant increase is also unlikely.

In the remaining months of 2024, businesses hope that major import markets will show better signals, inventory issues and transportation difficulties will ease, demand will recover, and prices will rise again. If all expectations play out favorably for shrimp, everything will shift in a better direction, ensuring the industry meets its goals for 2024.

For the pangasius export sector, Western countries have imposed bans on Russian pollock, benefiting Vietnamese pangasius. However, this also increases competitive pressure from other countries. Pangasius companies have faced a challenging year in 2023. In the first half of 2024, the entire industry focused on seizing every export opportunity. In the remaining months of 2024, it is expected that consumption demand will continue to rise as countries start preparing for festivals and holidays.

The export price of pangasius is also expected to show slight recovery and gradually increase in the remaining months of 2024 due to supply shortages resulting from low prices and adverse weather conditions, which have led many farmers to limit new stocking. However, exports to the EU market have been significantly affected by high freight costs, which greatly impacts companies' profits. Pangasius exporters hope for continued recovery in the final months of the year as major economies rebound in demand.

Vietnam's canned tuna exports have been increasing rapidly month by month. After facing record-high inflation and interest rates, consumers in many places tend to tighten their spending. Consequently, the demand for affordable products such as canned tuna has risen.

With the adaptation and adjustment to market conditions by enterprises, seafood export revenue is expected to reach 9.5 to 10 billion USD for the entire year of 2024. Among this, the shrimp sector aims for a target of 4 billion USD, pangasius is expected to reach approximately 1.9 billion USD, while other seafood products are forecasted to bring in about 3.6 to 3.8 billion USD.

According to data from the General Department of Vietnam Customs, Vietnam's seafood export turnover in August 2024 reached USD983.1 million, up 7.3% compared to July 2024 and 14.6% higher than the same period last year. This marks the highest monthly export turnover since the beginning of the year. In August 2024, all key export products showed growth: shrimp exports rose by 30%; pangasius fish increased by 18%; tuna rose by 13%; and other marine fish grew by 12%.

In the first eight months of 2024, total seafood exports amounted to USD6.3 billion, nearly 9% higher than the same period in the previous year. Of this, shrimp exports reached nearly USD2.4 billion, a 9% increase year-over-year (white leg shrimp accounted for USD1.75 billion, up 8%; black tiger shrimp reached nearly USD290 million, down 7%; and lobster exports surged by 140%). Pangasius exports amounted to nearly USD1.3 billion, increasing by 9%. Tuna exports rose by 21%, reaching USD652 million. However, exports of squid and octopus declined by 2% compared to the same period in 2023, totaling USD402 million.

Source: Vitic

DAILY: Domestic rice prices increased slightly on October 23, 2024

Pig price today October 23: Hanoi continues to purchase at 64,000 VND/kg

DAILY: Vietnamese pepper prices remained unchanged on October 23, 2024

DAILY: Vietnamese coffee prices decreased by 400 VND on October 23, 2024

Vietnam’s fruit and vegetable exports near 6 billion USD mark

Rubber exports to Malaysia grow by three digits

DAILY: Domestic rice prices up 50-100 VND per kg on October 22, 2024

Coffee Imports into EU Member States in the first half of 2024

Vietnam's coffee exports to the EU increased by 102% in value y-o-y in August 2024

DAILY: Vietnamese coffee prices remained unchanged on October 22, 2024

DAILY: Vietnamese pepper prices rose by 500-1,000 VND per kg on October 22, 2024

In the first 9 months of 2024, agricultural, forestry and fishery exports reached 46.28 billion USD

More than 90% total cassava exported to China in 9 months

Vietnam's fertilizer exports and imports in September and 9 months of 2024