Da Nang Rubber (DRC): Rising exchange rates have a positive impact on business results

Friday, June 28,2024

AsemconnectVietnam - Da Nang Rubber Joint Stock Company (stock code DRC) has just successfully organized the 2024 Annual General Meeting of Shareholders, approving a business plan of 15% growth in revenue but 7% decrease in pre-tax profit compared to implementation in 2023.

The DRC Annual General Meeting of Shareholders held on June 24 approved the business plan with the goal of industrial production value at actual prices reaching VND5,124 billion, an increase of 21% compared to 2023, total revenue Consumption reaches VND5,400 billion, an increase of 16% compared to 2023, net revenue reaches VND4,151 billion, an increase of 15% compared to 2023 and pre-tax profit reaches VND285 billion, equal to 93% compared to 2023 performance, corresponding to a decrease 7% compared to last year.

At the Congress, answering shareholders' questions about the impact of exchange rates on DRC, Company leaders said that DRC has an export proportion of 65-70%. The import of raw materials accounts for 35%, so the Company currently has a trade surplus, so the exchange rate has increased sharply recently, bringing high efficiency in the Company's production and business activities.

Commenting on the market, DRC leaders said that market demand depends on GDP growth rate. GDP in 2024 is forecast to be better than 2023. In addition, in 2024, the Government's drastic disbursement of public investment will have a positive impact on many industries, including the demand for tuberous products from which there is an opportunity to grow DRC's consumption products.

DRC competes fiercely with FDI products; however in recent years the Government has introduced many priority solutions to support domestically produced products (such as the program Vietnamese people prioritize using Vietnamese goods...). In 2024, DRC has very good output market signals for assembly units like Thaco.

For the US market, if the US market's demand is met, consumption will increase 2.3 times compared to today. For the Brazilian market, the Company said that in 2023, Brazil will increase import taxes on imported tire products, causing product prices when imported into the country to increase, making imported DRC products more difficult to compete with. . However, with product quality recognized and highly appreciated by customers, DRC output imported into Brazil is still maintained.

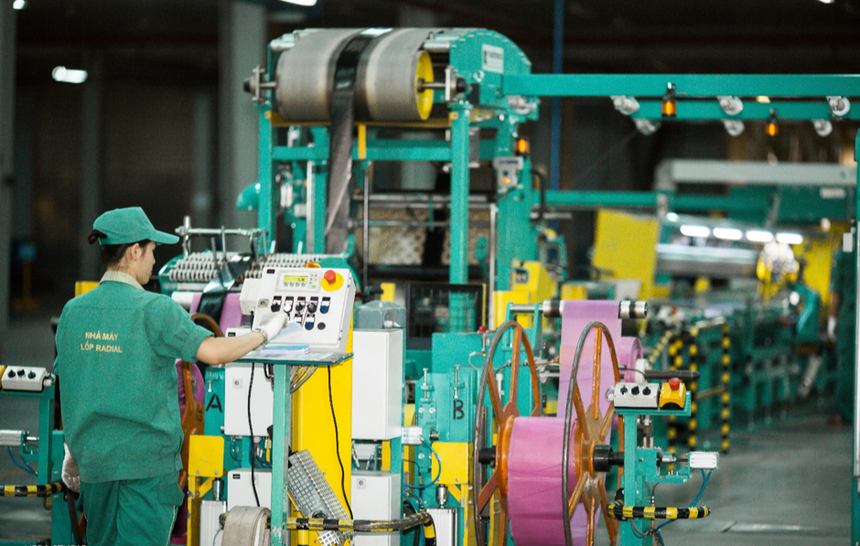

For the Radial phase 3 project, wherever the project's machinery and equipment are installed, they will be put into use. In 2024, the planned production and consumption of Radial tires is 900,000 tires, but when the project is completed, the capacity can be up to 1,200,000 tires/year. This will be the premise for the company's growth.

Answering the question about how natural rubber prices affect the Company's business plan, DRC Company leaders said that natural rubber prices move according to the rules, Vietnam is a country with rubber output ranks the second in the world. DRC always prepares every year for this. The Company has controlled this and reflected it in its business plan.

With the Radail project, from the beginning, the company informed that the Radail project would not be finalized until the fourth quarter of 2024. However, no matter how much investment the project has, production will continue. Currently, the capacity has exceeded 80,000 tires/month, so the project to be completed in the fourth quarter of 2024 has been set on target and is certain to be completed.

Answering the question about the business plan set for 2024 being lower than 2023, DRC leaders said that in 2024 the profit set is lower than in 2023 because in 2024 the Company produces many new products such as PCR must invest in new sales policies and product prices must be suitable for the market, with fierce competition. In addition, in 2024, the Radial phase 3 project will go into operation, so fixed asset depreciation costs will increase, so the profit plan will decrease compared to 2023.

N.Nga

Source: VITIC/Tinnhanhchungkhoan

PJICO (PGI) launches a new brand identity to celebrate its 30th anniversary

Guotai Junan Securities (IVS) plans to increase its charter capital to VND1,387 billion

Becamex IDC (BCM) mobilizes an additional VND800 billion in bonds with an interest rate of 10.5%/year

PNJ's net revenue increased by nearly 37% in the first 5 months of 2024

Chuong Duong (CDC) wants to mobilize VND241.88 billion from shareholders, most of the money raised to invest in the project

Minh Phu Seafood (MPC) will promote shrimp exports to China

VNECO (VNE) will reduce its ownership in VE3 to 20%

An Duong Thao Dien (HAR) sets profit target down in 2024

Moc Chau Milk (MCM) officially listed on HOSE, reference price VND42,800/share

Masan Consumer (MCH) locked in the right to pay 55% cash dividend

GELEX (GEX) and FPT cooperate to promote comprehensive digital transformation

DIC Corp (DIG): Returned to profit in Q2/2024 but the first half profit still decreased by 67.1%

PVOIL (OIL) entered the Ranking of 500 largest companies in Southeast Asia - Fortune Southeast Asia 500

Hai Phong Thermal Power (HND) achieved VND379.02 billion profit in 5 months, completing 96% of the year plan